How does Fawley fit into the UK Government Strategy for Net Zero?

First, it may be helpful to recap the three strategic decarbonisation options being considered by the UK Department of Energy Security and Net Zero (DESNZ).

Carbon Capture and Storage (CCS) is the short-term solution, letting existing industrial processes keep running while trapping the carbon output from their exhaust gases. It’s the most cost-effective solution where existing offshore oil industry pipeline and exhausted underground aquifer storage exists. In 2024, SPS reported extensively on ExxonMobil’s exploratory proposal for a CO2 pipeline leading to a speculative and unlicenced offshore aquifer south of the Isle of Wight. That project generated significant public opposition in the New Forest and on the Isle of Wight, before being shelved within days of the initial consultation closing for lack of government support.

Blue hydrogen is seen as the medium-term solution, making hydrogen using the currently established practice of refinement from natural gas, but capturing the CO₂ that comes with it and storing it underground. This is a low-carbon, rather than a zero carbon approach. While ExxonMobil have proposals in mind with SGN (the gas network), the lack of local carbon storage options would appear to act against it as a viable investment opportunity.

Green hydrogen is the strategic goal, using wind or solar electricity to split water into hydrogen and oxygen. This type of hydrogen is a clean fuel – when you burn it or use it in an industrial process, the only by-product is water. By the mid-2030s the government’s optimistic hope is that this source should be cheaper than the first two options.

Note: The terminology here is deceptive. None of these technologies could be considered ‘cheap’, few of them are commercially proven and all of them, to varying extents, are still emerging.

The UK strategic carbon capture and hydrogen projects are most advanced in the industrialised north of England, where a diverse range of potential industrial customers exist ready and able to consume the new clean energy sources at scale. Taking the local Solent perspective, the only significant industrial-scale emitters of carbon on the south coast are the Fawley Refinery itself and the electricity generating power stations.

What would the ‘green’ hydrogen be used for?

Green hydrogen from Fawley would provide a carbon-free source of fuel for exclusive use in the petrochemical processes at the Fawley refinery complex. Refineries are under pressure to meet tougher standards for ultra‑low‑sulphur fuels. Until now, they have relied on hydrogen made from fossil sources, typically from imported natural gas, but rising carbon costs are rapidly eroding its affordability. As carbon pricing legislation takes hold, the economics shift decisively: fossil‑based hydrogen becomes a liability, while green hydrogen emerges as the most cost‑effective path to full compliance.

Green hydrogen production via electrolysis involves splitting pure, deionised water into its component molecules (hydrogen and oxygen) by electrolysis, using renewable electricity. The process remains in early commercial phases of development globally, with the largest known implementation being a 260MW facility operational in China since 2023.

Spain began operating the largest European facility, sized at 20MW in 2023, while EDF/Hynamics – the company behind the Fawley proposal – are currently in the early phases of production at a 7.5MW plant on Teesside. Experience from the Teesside pilot operation, starting small to prove scalability, would be used to inform the proposed development on the former Calshot power station site. If it is constructed, the new EDF facility would be fully integrated with ExxonMobil’s operations in the hope of achieving rapid emissions cuts at Fawley.

How does this relate to ExxonMobil‘s 2024 CO2 Pipeline proposal?

There are similarities between ExxonMobil’s 2024 Solent CO2 carbon capture and storage pipeline proposal and the 2026 Fawley green hydrogen proposal. Both initiatives share the same ambition: to cut the carbon emissions from the Fawley refinery complex. Each proposal relies heavily on substantial UK government support. In 2024, ExxonMobil were unsuccessful in securing funding through the second round of the government’s carbon capture programme. Today, the company is providing the guaranteed ‘off-take’ buyer role supporting EDF’s application under the Hydrogen Allocation Round 2 (HAR2), shortlisted in April 2025. Without ExxonMobil as a guaranteed buyer of the product, EDF has no viable project. The two companies are interdependent in this venture.

The Hydrogen Allocation Round 1 (HAR1) funding was spread across eleven small projects totalling 125MW nationwide, including Teesside, Humber, Scotland and the north-west. The committed green hydrogen users span diverse industries, including distilleries, haulage, chemicals and power.

The Fawley Green Hydrogen proposals is one of 27 electrolytic green hydrogen projects shortlisted under the UK government’s Hydrogen Allocation Round 2 (HAR2), the largest being the 200MW Grangemouth Green Hydrogen proposal led by RWE Generation UK.

Focussing on the proposed Fawley site

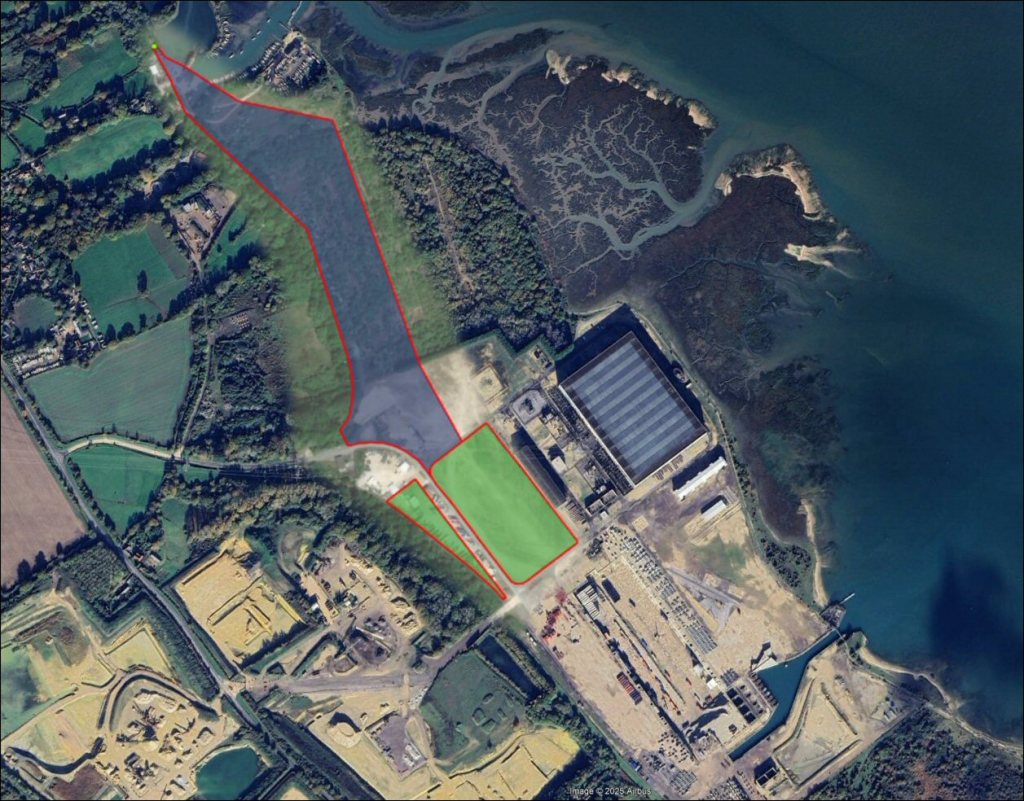

The slides below overlay the proposed development site (green) and the pipeline corridor (blue) on the current Google Earth view of the site.

The project infrastructure – such as new pipelines, electrical connections or storage areas – must be assessed for potential effects on sensitive habitats and species already under pressure from climate change and coastal squeeze. The width of the pipeline corridor will be of interest to the Ashlett Creek community but is not yet stated. That corridor will be carrying outbound low pressure hydrogen and oxygen generated by the process, potentially with inbound source water from the refinery as input to the electrolysis process. Also, as yet unstated, is whether there would be additional onsite renewable sources of energy, wind turbines or solar farm units. The primary ‘local’ sources of renewable energy for the site include the Rampion offshore wind farm to the east of the Solent.

Fawley once again finds itself in direct competition with Grangemouth for public and private investment funding. But has Grangemouth stolen a march on Fawley? Both are proposing development of green hydrogen plants, but Grangemouth, having already effectively initiated the decarbonisation of its refinery by the decision to shut it down, is working with several partner hydrogen ‘off-take’ buyers (commercial consumers of the green hydrogen). Fawley, on the other hand, is dealing with just one client – the Fawley Refinery – thereby having ‘all its eggs in one basket’. With plenty of industrial areas requiring its future green hydrogen, some might consider that Grangemouth has spread its commercial risk wider. The alternative view would be that the Fawley green hydrogen plant has at least one guaranteed customer for 100% of its output for the foreseeable future, i.e. Fawley refinery.

Solent Protection Society will be closely monitoring how the Department of Energy Security and Net Zero arrive at a decision on these two large scale hydrogen projects.

Since ExxonMobil have so far failed to secure carbon capture funding or a carbon storage licence, finding significant investment in Blue hydrogen seems unlikely. For ExxonMobil, the most realistic pathway would be green hydrogen, but critics will continue to question whether this is genuine transformation or a delay tactic. Those same critics could argue that the quickest, most effective decarbonisation strategy for ExxonMobil would be to follow Grangemouth’s lead and shut the refinery operation down, opening up a strategic investment program for green employment on the New Forest / Southampton shore.

Ultimately, the final decision on the future of Fawley Refinery hinges on government policy, regional infrastructure, and European collaboration – not just ExxonMobil’s corporate strategy.

Hynamics are running a drop-in event for the local community on Thursday 8th January at Jubilee Hall, The Square, Fawley Village, SO45 1DF, from 3:30 pm – 7:30 pm.

(The meeting originally scheduled for Wedneday 10 December has now been cancelled. )

How are green hydrogen projects measured? A thought-provoking question

In case you’ve asked yourself why green hydrogen projects are measured in MW, rather than volume of gas produced, the answer is explained by the uneven supply and questionable reliability of renewable energy as an exclusive resource.

Electrolysers are often described in terms of their size, measured in megawatts (MW). This figure tells you how powerful the “engine” is, but not how much hydrogen it will produce. The output depends entirely on how many hours the electrolyser can run each year – and that, in turn, depends on the availability and price of renewable electricity. If green power is plentiful and affordable, the plant can run continuously and deliver large volumes of hydrogen. But when the energy source is too costly, or interrupted by lack of sunlight or periods of calm, production falls sharply.

Because these variations are so significant, MW capacity is the only reliable and comparable figure when new projects are announced or funded.

Solent Protection Society is a small local charity managed by a Council of volunteer trustees.

Established 1956 – Registered Charity 1154317

We would welcome your support