This is the third SPS post on the subject of the ExxonMobil ‘Solent CO2 Pipeline Project.

The front page summary post, which is the best place to begin for the reader new to the subject, can be found by clicking this link.

Alternatively, the full list of SPS Posts on the subject can be found by clicking this link.

Solent Protection Society has previously noted that the current ExxonMobil Solent CO2 consultation is ‘worryingly flawed and incomplete’. In this post, we explore those concerns further.

In defence of ExxonMobil, we appreciate the company’s decision to solicit the views of the public with this pre-application consultation, in advance of a potential application to the Planning Inspectorate for a Development Consent Order (DCO) for a Nationally Significant Infrastructure Project (NSIP).

We welcome the opportunity to assist ExxonMobil by pre-empting some of the detailed points of assessment that the proposal should come under if and when it is formally submitted for consideration.

(Following our usual approach with SPS website posts, we invite you to click on underlined italic text where present to open relevant reference material.)

The Solent Cluster context

ExxonMobil is promoting its Solent CO2 project through the auspices of the Solent Cluster, originally an initiative by ExxonMobil, the University of Southampton and the Solent LEP launched in November 2022. With the publication of the Solent Cluster Socioeconomic Report in March 2024, the Solent Cluster network of businesses was expanded to bring in the former members of the now-disbanded Solent Local Enterprise Partnership (LEP), formerly focussed on the delivery of the Solent Freeport.

The term ‘cluster’ is widely used in the petrochemicals industry to group manufacturing units that share utilities and large-scale infrastructure such as power stations, storage tanks, port facilities, road and rail terminals and pipelines. More recently, it has been adopted by the UK government Department of Energy Security & Net Zero (DESNZ) to define local networks of businesses proposing Carbon Capture, Usage and Storage projects.

The use of the term in the branding of the former Solent Local Enterprise Partnership (LEP) is deliberate. With the original Solent LEP Freeport ambition now scaled back, the newly energised Solent Cluster now appears to be mainly focussed on marketing a reimagined Fawley manufacturing site within a broad marketing-focussed vision.

The wider UK Carbon Cluster context

Given the strength of initial public reaction to the ExxonMobil Solent CO2 proposal consultation documents, it is worth drawing a comparison with the other UK industrial groups proposing to operate in the same industrial space. Click the images below for details of just three.

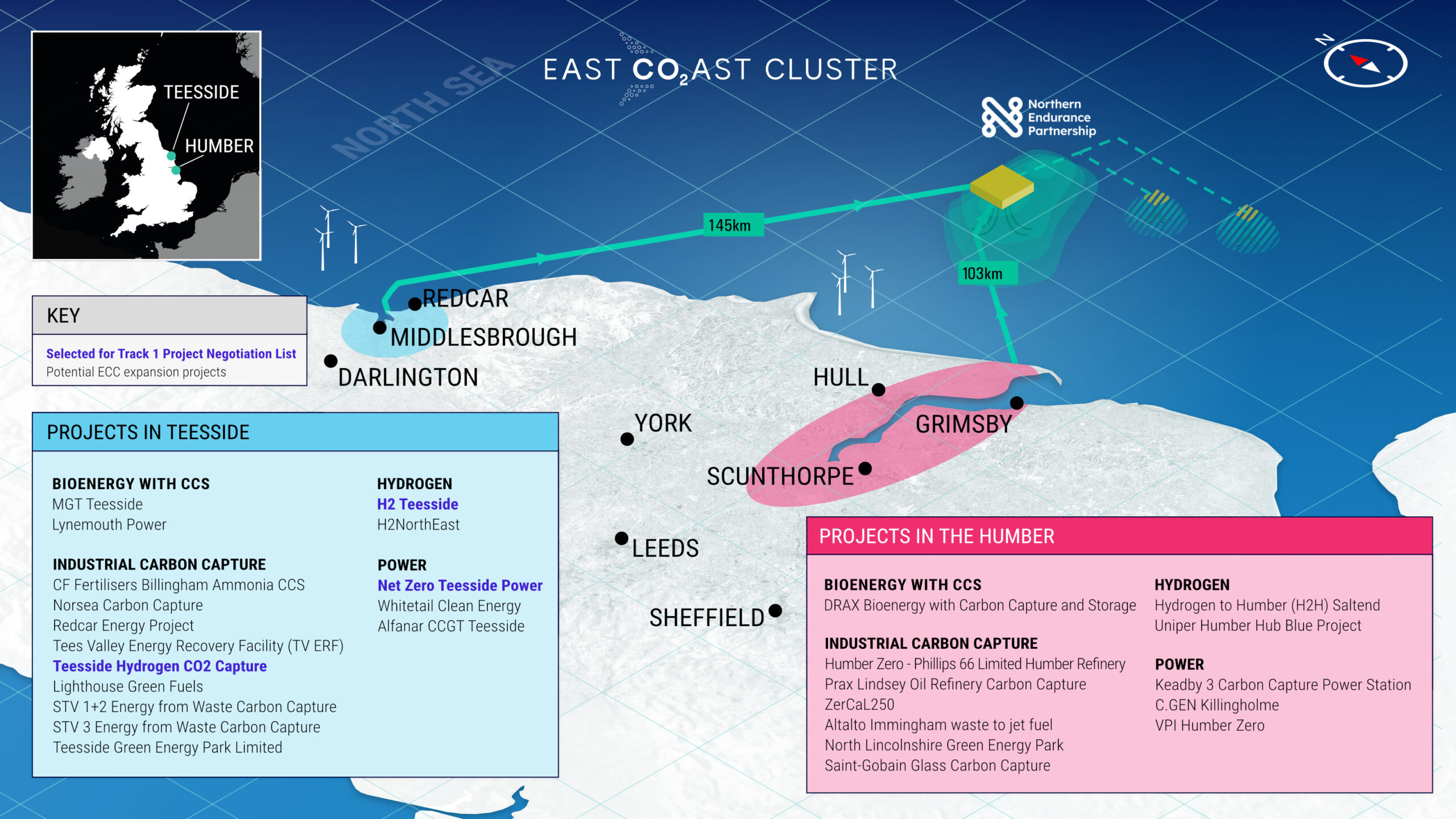

It is worth taking a detailed look at the companies and initiatives which make up the East Coast Cluster and considering the maturity of that combined industrial base and its long-established experience of North Sea operations.

While the East Coast Cluster is the most appropriate industrial reference model for assessing ExxonMobil’s proposal, it is the Peak Cluster which will offer a benchmark for the environmental impact of a land-based ‘cut and trench’ pipeline on a sensitive landscape.

The Peak Cluster is looking to build a CO2 pipeline to an Irish Sea storage site from a group of cement and lime manufacturing facilities companies across Derbyshire, Staffordshire and Cheshire. With five cement production sites in and around the Peak District National Park, the Peak Cluster already faces a similar environmental challenge to that which is now being observed by ExxonMobil with its Solent CO2 proposal.

There are, however, significant differences between the Peak Cluster and Solent Cluster endeavours. The Peak Cluster comprises a strongly-focused alliance of national and international cement and lime manufacturing companies. The inland location of its manufacturing sites, some of which are in locations of significant environmental sensitivity, leave no alternative to a land based pipeline tunnelling and trenching operation.

Where does this leave the Solent Cluster?

Hynet North West and East Coast Cluster were the two ‘Track 1 Clusters’ approved by the DESNZ as part of the UK Government’s Carbon Capture, Usage and Storage (CCUS), and with the Track 2 Clusters now announced as Viking, also on Humberside, and Acorn, in the Scottish Cluster, it would seem that the Solent Cluster is some way behind in a field of ‘also rans’.

The ‘Solent Cluster Socio-economic report’ published in March 2024 highlights six ‘anchor projects’, five of which relate to the ExxonMobil facility, with an additional minor component based on the potential greening of the Marchwood waste incinerator.

The current consultation by ExxonMobil is testing the water for a potential application to the DESNZ for a Development Control Order for what the company believes is justified as a Nationally Significant Infrastructure Project. There are seven equivalent NSIP projects among the 230+ DCO applications currently registered with the Planning Inspectorate, including carbon capture and storage facilities, hydrogen development projects and pipeline routes promoted by the currently accepted Track 1 and Track 2 CCUS clusters.

In contrast with the size, scale and maturity of the major players, the Solent Cluster represents just one main petrochemical manufacturing site and a small green waste operation at Marchwood incinerator. While it mentions an offshore carbon storage site, it fails to provide any detailed documentation. Exploration, assessment and analysis of the potential of this storage site remains subject to regulatory licencing and despite its proximity to sub-sea pipeline corridors, ExxonMobil has not clearly explained its reason for rejecting these options.

Environmental and Social Governance (ESG)

The hard-to-decarbonise industrial sectors such as power generation, manufacturing, refining, steel, cement, and petrochemicals are all considering the impact of their CO2 production on the planet, on their public reputation and on their shareholder value. All these companies are developing strategic Environmental and Social Governance (ESG) policies and all are producing highly detailed sustainability strategies.

ExxonMobil is no exception and any attempt to refer to the company’s online content on sustainability, results in a detailed disclaimer that speaks volumes, paraphrased in just one of its component sentences.

“These statements are not guarantees of future corporate, market or industry performance or outcomes for society and are subject to numerous risks and uncertainties, many of which are beyond our control or are even unknown.”

External regulatory governance

It is in the face of these risks and uncertainties that the importance of clear governance over the Nationally Significant Infrastructure Project application process becomes critical. By discounting what appears to be obvious undersea route options before the current consultation began, the public have been presented with a ‘Hobson’s choice’ between three equally unpalatable options. The consultation will provide only an inconclusive view of which of the proposed pipeline routings is the lesser of the three evils. For an industry that has already delivered far longer and more challenging North Sea routes, an undersea route through the inshore shallows of the Solent should present little difficulty.

SPS appreciates that some areas of the Solent are currently protected by important maritime environmental designations and that oyster fisheries, seagrass beds and bathing beaches, all of which need to be carefully considered. However, the environmental impacts in the maritime environment may be found to be less problematic than in the overland corridors currently proposed.

Before the application can be submitted to the Planning Inspectorate, Solent Protection Society believe that the end-to-end subsea routes should be reinstated to the route shortlist. While we accept that the general public would undoubtedly vote en-masse for the offshore routes, inclusion of these routes should ensure that the NSIP governance process would deliver the appropriate decision based on a fully open and transparent assessment of the financial and environmental costs associated with both land-based and offshore routes.

In summary

The ExxonMobil proposal is at an early stage of definition, drafted in advance of any clear understanding of the viability and capacity of the English Channel storage site. By dismissing the obvious site-to-site subsea pipeline routes, the company has maximised the environmental cost to the Solent region of what could prove to be little more than a vanity project with minimal real opportunity for decarbonisation.

The Solent Cluster is formed predominantly of ExxonMobil, aligned with academic institutions, local authorities and a wide variety of disparate businesses. The only large industrial parties in the list are in shipping and port management, for which the solutions to decarbonisation are completely different.

By contrast, the heavy industrial projects within the established major UK Clusters are already well-established in the NSIP process and share the advantage of having direct undersea pipeline routes to established oil field CO2 storage sites. The ExxonMobil proposal would only serve a single manufacturing site, Fawley, and is reliant on an unproven and currently unlicensed storage facility of more limited scale in the English Channel.

If this proposal gets as far as being submitted as a formal application, SPS will be looking to the Secretary of State for Energy Security and New Zero to ensure that the financial and environmental justification is properly scrutinised and made public.

SPS will be also expressing our views directly to the Planning Inspectorate and the Secretary of State at the Department for Energy Security and Net Zero, DESNZ, for consideration in the decision whether or not to accept the currently defined application by ExxonMobil onto the NSIP register.

As part of our response, we will also be questioning ExxonMobil’s justification for considering its project as a Nationally Significant Infrastructure Project under the terms published by the Planning Inspectorate. It might more simply be viewed by some as an attempt to secure public funding for what is essentially a market-driven reinvention of its Fawley manufacturing facility.

This is the third SPS post on the subject of the ExxonMobil ‘Solent CO2 Pipeline Project.

The full list of SPS Posts on the subject can be found by clicking this link.

To read the next in the series, click here.